Feb 2, 2026

Author: Şeyma Yılmaz Köse

In recent years, the concept of risk for companies is changing silently but profoundly. It is no longer just interest rates, commodity prices, or geopolitical developments; land productivity, water regimes, and ecosystem resilience are becoming part of financial planning. In simpler terms, the loss of nature stops being an abstract environmental issue and becomes a risk that is measured, priced, and reflected in balance sheet items.

This transformation presents companies with an unfamiliar question: How does the degradation of nature occurring outside their control affect corporate value? How can an ecosystem disruption that arises in the supply chain change raw material prices, insurance costs, or production continuity?

At this point, biodiversity is gaining a new position on the ESG agenda. Just like the Scope 3 emissions that were once overlooked but are now closely monitored by investors, biodiversity emerges as a risk area that shapes beyond a company's direct operations but has direct financial repercussions.

Just as Scope 3 emissions reveal the true complexity of climate action, biodiversity is becoming the next major frontier in ESG. Therefore, more and more experts define biodiversity as "the new Scope 3 of ESG."

Why the "Scope 3" Analogy?

This analogy is not a random analogy. Recall Scope 3 emissions: the carbon footprint that is outside the direct control of the company but for which they are still responsible. It combines hard-to-measure points such as suppliers, logistics, and customer usage; however, when ignored, half of the climate strategy remains unfulfilled.

Biodiversity operates exactly like that.

The impact of a company on nature is often observed beyond the limits of its own facilities. Elements like lands used in the supply chain, water resources, raw material extraction, and indirect ecosystem effects broaden this impact area. Control is partly limited, but financial risk is entirely on the company.

This structure puts companies in a challenging equation: A risk area that you cannot directly manage but cannot escape from its consequences.

Why is Biodiversity Loss a Financial Issue?

For many years, biodiversity loss was considered an environmental issue. Species that need to be protected, disappearing habitats, sensitive ecosystems, and similar topics were subjects of conservation. However, recent studies clearly demonstrate that the degradation of ecosystems leads to direct financial consequences for companies.

Is the water cycle weakening? Costs are rising for agricultural and production companies. Is soil productivity decreasing? The food supply chain is under risk. Are pollination services declining? Global agricultural production is under threat.

Such impacts are no longer just headings in CSR reports; they are becoming agenda items discussed in risk management meetings. Financial institutions, investors, and rating agencies are increasingly viewing biodiversity loss as a priced risk.

Regulations Are Coming Into Play: ESRS E4

One of the most concrete indicators of this transformation is the ESRS E4 Biodiversity and Ecosystems standard published under the European Sustainability Reporting Standards. ESRS E4 does not only expect companies to make vague commitments like "we protect nature" that are abstract and lack specificity. Instead, it provides a much more specific framework:

What impact do your activities have on ecosystems?

In what aspects are you dependent on these ecosystems?

How is land use, habitat loss, and ecosystem degradation shaped throughout your value chain?

Therefore, the scope is not limited to the company's own operations. Just like in Scope 3 emissions, the impacts that arise throughout the value chain are evaluated as a natural part of reporting and the process is addressed holistically.

Translating Nature into Risk Language with TNFD

In addition to regulations, one of the emerging voluntary frameworks in recent times is the Taskforce on Nature-related Financial Disclosures (TNFD). Similar to the common language created by TCFD on the climate side, a framework for biodiversity is being built with TNFD.

The most valuable contribution of TNFD is that it addresses biodiversity from two different perspectives: impact and dependence.

Impact: What damage does the company cause to nature?

Dependence: What ecosystem services does the company’s business model rely on?

The second aspect is particularly critical. Because a company can carry high risk due to its dependence on nature even if it does not harm nature at all. For example, consider a beverage company that is highly dependent on water resources. Disruption of the water cycle directly threatens the operational continuity of that company.

Or conversely, as an example of indirect impact, a company sourcing palm oil for biodiesel production may not directly cut down forests but indirectly causes habitat loss and carbon emissions due to its suppliers converting tropical forests into agricultural land. This impact remains invisible in the company's own operations, but in terms of reputational risk, regulatory pressure, and supply continuity, it returns directly to the company.

TNFD provides a methodological foundation for translating such risks into financial terms.

Moreover, TNFD recommends that companies conduct geographically based analyses. Because biodiversity risks, unlike a global carbon footprint, are highly dependent on local and regional dynamics. Each geography has its own ecological sensitivities, and for exactly this reason biodiversity cannot be measured by a single metric.

Let's think about a concrete example: Imagine a company that is heavily dependent on water and operates in an area suffering from water stress or drought. If this company does not consider water risk in its risk assessment, how seriously can you take that study? Therefore, geographical context is essential for biodiversity assessments.

How Do ESRS E4 and TNFD Work Together?

Although these two frameworks were developed for different purposes, in practice, they complement each other perfectly:

ESRS E4 answers the question "what will you report?".

TNFD provides methodological solutions for the question "how will you analyze this information?".

When used together, companies can meet regulatory expectations and produce coherent responses to investors’ questions about nature-related financial risks.

A Critical Step from ISSB: Nature is Now on Standard Agenda

At the end of 2025, there was a turning point in global sustainability reporting. The International Sustainability Standards Board (ISSB) decided to develop a new reporting standard for nature-related risks and opportunities. This decision is a strong indication that biodiversity and ecosystem risks are now moving from being an "optional" topic to become central in mainstream financial reporting.

This step by the ISSB is particularly significant because this board, which is also the architect of the original texts of the TSRS applied in Turkey, is expected to publish a draft standard related to nature by the CBD COP17 summit scheduled for October 2026.

From Voluntary to Mandatory: A New Era in Biodiversity Reporting

The ISSB announced that it would leverage the TNFD (Taskforce on Nature-related Financial Disclosures) framework in the process of developing new standards. As a result of this collaboration, TNFD will complete its current technical work in the third quarter of 2026 and focus on the integration with the ISSB.

This development is not coincidental. The number of organizations adopting TNFD recommendations has reached 733, and these organizations represent a total market capitalization exceeding $9 trillion and total assets under management exceeding $22 trillion. These figures clearly demonstrate how critical nature risks have become for institutional investors.

A Framework to be Built on IFRS S1 and S2

The ISSB's approach is to develop nature standards not as an independent reporting line but in a complementary manner to existing IFRS S1 (General Sustainability Requirements) and IFRS S2 (Climate-related Disclosures) standards. This means that nature risks will be addressed in an integrated manner along with climate risks.

How the ISSB will structure its nature standard is not yet clear. Possible options include a new independent standard, additions to existing standards, or sectoral guidance. However, whatever the approach, the goal is clear: to provide comparable, consistent, and financially meaningful nature information for investors.

Why Now?

The fundamental driving force behind these developments is investor demand. In recent years, scenario analyses, stress tests, and risk assessment tools developed for climate risks are expected to be applicable to nature risks such as water scarcity, soil degradation, and ecosystem collapse. Because these risks directly affect companies' long-term value creation capacity.

As ISSB Chairman Emmanuel Faber emphasized, utilizing the TNFD framework allows addressing this need efficiently, reducing fragmentation, and basing it on leading practices.

The message for companies is clear: Biodiversity is no longer an environmental issue; it is a strategic business risk. Soon, explaining how these risks are managed will become a standard expectation, just like it is for climate risks.

Where Should Companies Start?

One of the most common misconceptions about biodiversity is the notion of "first complete measurement and quantitative data, then action." However, studies show that it is healthier for companies to prioritize qualitative risk definition and prioritization.

A practical starting point could include the following steps:

1. Geographic Mapping: In which regions are your activities and supply chains concentrated? What is the ecological sensitivity of these regions?

2. Dependence Analysis: On which ecosystem services does your business model rely? To what extent are you dependent on elements like water, soil, pollination, and climate regulation?

3. Risk Prioritization: In which geographies and for which activities does biodiversity loss pose the greatest financial risk?

4. Initial Goals and Action Plan: Set specific targets in priority risk areas. In the beginning, steps taken in the right direction are more valuable than perfect measurements.

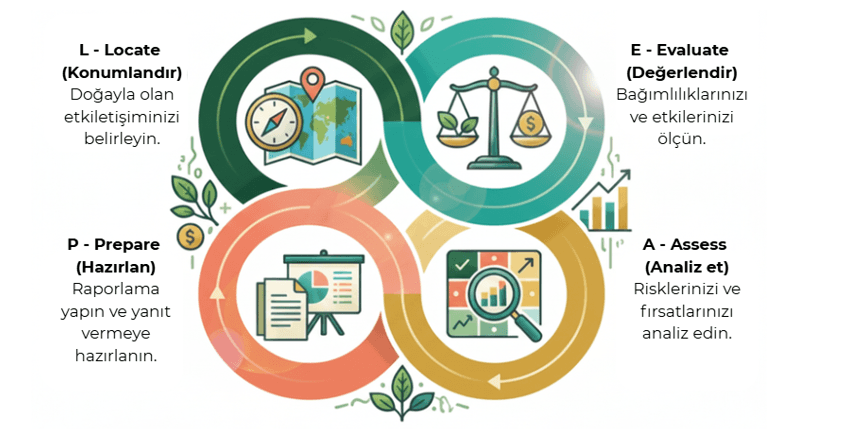

The TNFD's LEAP approach presented in the graph below offers a structured method for companies to identify nature-related risks step by step. This framework systematically encompasses the entire process from geographic location to risk assessment.

A New Threshold for ESG

Today, biodiversity occupies a position in corporate sustainability similar to where climate stood 5-10 years ago: Difficult to measure, complex to manage, but no longer negligible.

Just as Scope 3 emissions eventually found their way to the center of ESG reporting over time, biodiversity is following a similar trajectory. Regulations are tightening, investor expectations are becoming clearer, and perceptions of risk are changing. For companies that act early and establish the right framework, this process is not just a compliance obligation; it also represents a strategic advantage. Because biodiversity is no longer just a narrative issue. It is a new threshold of ESG that must be managed regarding risks, dependencies, and financial impacts.

You can reach out to us for support on biodiversity risk assessment, nature dependency analysis, and TNFD compliance, as well as information about our work in sustainability risk and scenario analyses.

References

IFRS, Objective and scope of standard-setting on nature-related risks and opportunities, Staff paper

Taskforce on Nature-related Financial Disclosures (TNFD). Aligning Business Strategy with Nature (2025).

TNFD. LEAP Approach Guidance and Nature-related Risk Assessment Framework.

Sustainable Investment Institute (SII). Biodiversity and Business Risk: From Environmental Impact to Financial Materiality.

Liu, Z. (2025). When TCFD Meets TNFD: Can It Revolutionize Corporate Sustainable Risk Management? Business Strategy and the Environment.

EFRAG. ESRS E4 – Biodiversity and Ecosystems: Standard Requirements and Value Chain Implications.

Sustainable Investment Institute (SII). Corporate Biodiversity Reporting: Challenges, Gaps and Good Practices.